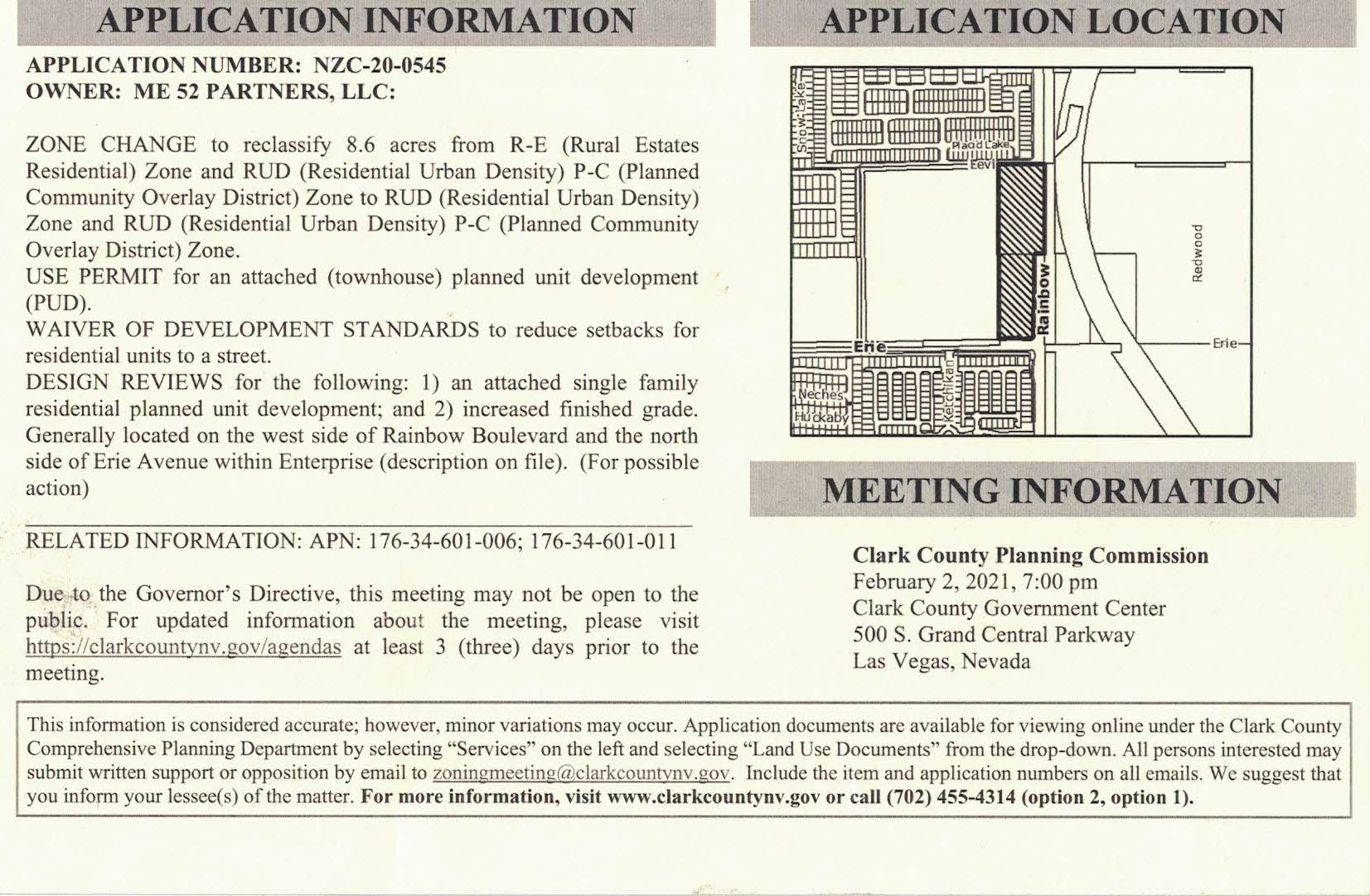

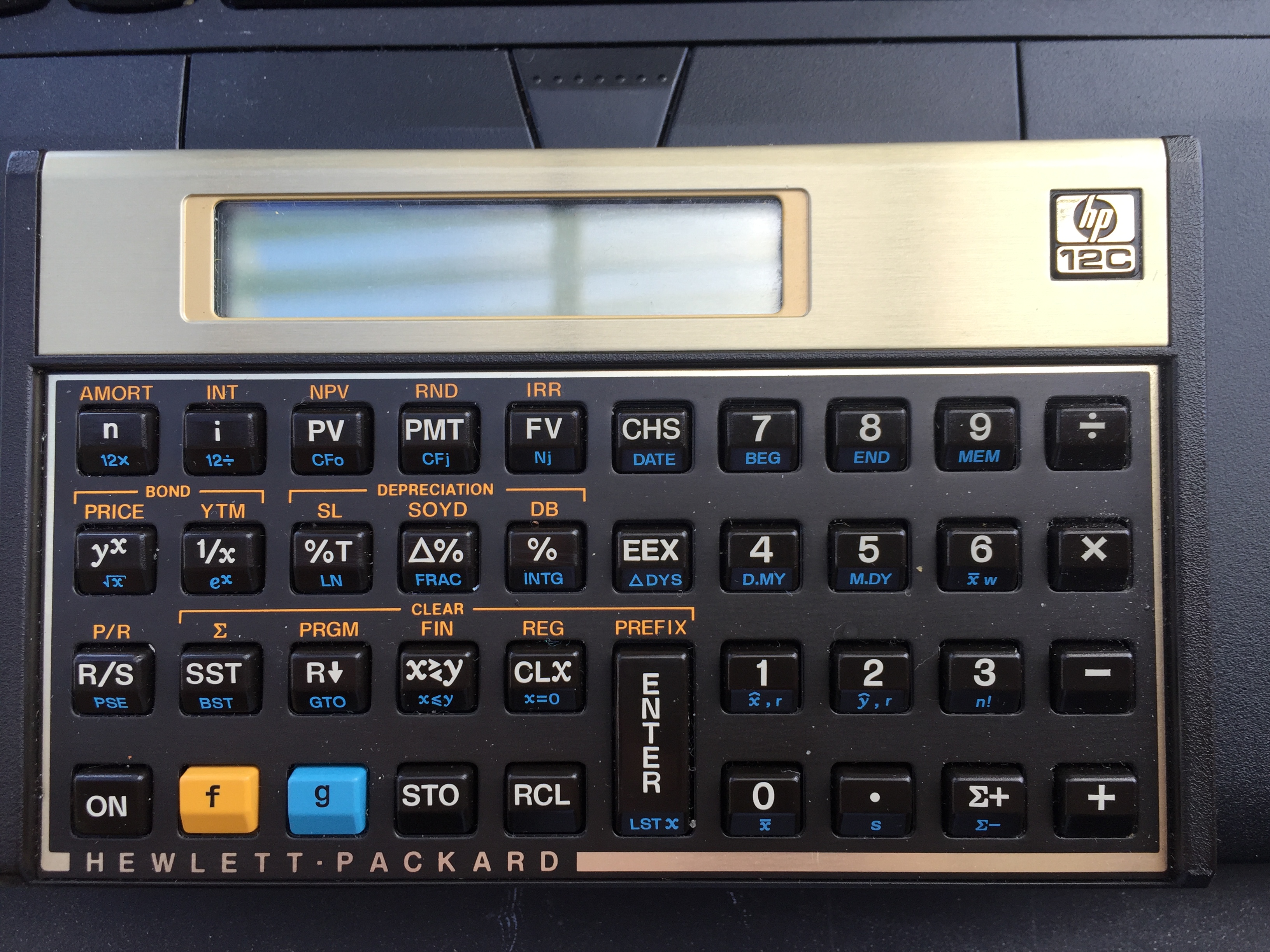

Without a doubt, investing in real estate is best done with a firm grasp of the financials involved. Financial calculations can appear daunting to say the least. With a quick look at the HP-12C financial calculator shown above you’ll quickly begin to wonder what the heck all those buttons do. While I don’t use all of them, using a similar calculator to quickly and accurately assess your costs and returns involved in real estate can help you immensely when evaluating investment opportunities. Is it better to invest in a vehicle that returns 16% annually but compounds only every three years, or an investment that returns 12% but can be compounded every two?

I recently did calculations for this example above & found, though compounding interest periods are a vital component of assessing how your money will grow or shrink overtime, the 16% return that compounds every three years is indeed a better investment for my 18 year horizon. In order to do this I had to use both my HP-12C and an excel spread sheet. Excel has many of the calculations the 12C does built right into it, but I’ve been really enjoying using the HP after reading a book that is basically half education on how money works, and half instruction manual to the HP-12c. This book relies heavily on the use of this exact calculator to illustrate it’s figures & if you’re looking for a solution you can carry around in your pocket without needing to lug your laptop around, I’d highly recommend reading it. The title is “Taking The Mystery Out Of Money” by Lonnie Scruggs, a now deceased investor who focused on flipping mobile homes. You don’t need to be interested in mobile home investment to benefit from his knowledge about how money works, and the material is so beneficial I’m left wondering why this book isn’t required reading somewhere along the education cycle of a high school senior.

The second book is definitely more real estate focused in-depth, but uses Microsoft Excel …

Read More